While in the ever-evolving landscape of digital finance, innovations pushed by distributed ledger technological innovation are ever more actively playing a pivotal position. Nowadays, economical services are going through profound transformations, reshaping standard systems and introducing new alternatives for progress, safety, and accessibility. By leveraging decentralized technologies, electronic finance is increasing its arrive at, producing ground breaking options that are not only disrupting recognized establishments but also empowering individuals and firms throughout the world.

The Increase of Decentralized Finance Techniques

One of several most significant improvements to arise in the world of electronic finance is the development of decentralized finance (DeFi). As opposed to standard finance methods that depend on centralized establishments which include banks, DeFi platforms operate on blockchain networks which might be open up, clear, and available to anybody by having an internet connection. This decentralized character gets rid of intermediaries, reducing transaction prices and enabling quicker, safer financial transactions.

Decentralized finance techniques permit buyers to engage in a wide range of financial pursuits, including lending, borrowing, investing, and preserving. These companies are usually powered by good contracts, that happen to be self-executing agreements published in code that mechanically execute when predefined situations are achieved. This automation reduces the necessity for intermediaries, including brokers and legal professionals, As a result speeding up processes and reducing the probability of human mistake.

In addition, DeFi platforms deliver worldwide entry to fiscal solutions, which is especially critical for individuals in underserved or unbanked locations of the planet. With just a smartphone and an internet connection, any individual can get involved in these digital finance networks, opening up new financial alternatives and driving economical inclusion.

Security and Transparency by Dispersed Ledger Know-how

A further important innovation introduced about by blockchain technological know-how is the enhanced safety and transparency it provides. In regular economic programs, central authorities are answerable for maintaining data, and there is often the probable for fraud, hacking, or info manipulation. However, blockchain operates on a decentralized, immutable ledger, which makes certain that at the time info is recorded, it can't be altered without the consensus on the network contributors.

This amount of transparency and stability has main implications to the economic sector. One example is, transactions conducted on blockchain networks are visible to all members, generating an open and verifiable history of activity. This is particularly important for combating fraud, income laundering, together with other illicit pursuits. The chance to observe the movement of assets and validate the authenticity of transactions with these types of certainty fosters have faith in and self-confidence amid consumers and buyers.

In addition, the decentralized character of blockchain usually means that there's no solitary place of failure. Distributed nodes throughout the network be sure that facts is constantly replicated, which makes it a lot more resilient to cyberattacks or technique failures. This standard of safety is An important gain with the financial market, exactly where the safety of delicate information is paramount.

Smart Contracts: Revolutionizing Business Operations

Sensible contracts are another groundbreaking innovation that is definitely reshaping the entire world of digital finance. These self-executing agreements are created to immediately enforce the conditions of the contract once the problems are fulfilled. Smart contracts eradicate the necessity for intermediaries, streamline processes, and lower administrative prices.

In business functions, intelligent contracts can be used to aid transactions, create insurance policy agreements, deal with offer chain management, and much more. They are now staying integrated into industries for instance property, insurance coverage, and in many cases healthcare, the place they can automate plan tasks, strengthen transparency, and decrease the chance of disputes. By making trustless agreements that dont depend upon a central authority, smart contracts empower organizations to operate much more effectively and securely.

Electronic Assets and Tokenization

Tokenization, the entire process of converting true-entire world belongings into digital tokens on a blockchain, is an additional transformative innovation in the realm of electronic finance. By means of tokenization, numerous property including real estate, commodities, and perhaps intellectual assets could be represented digitally, enabling for easier plus much more economical trade.

Tokenizing belongings opens up new avenues for expenditure by enabling fractional ownership. One example is, as an alternative to needing big quantities of cash to take a position in the property or artwork, folks can now obtain fractions of those assets in the shape of electronic tokens. This will make higher-price investments far more obtainable into a broader audience, democratizing prosperity generation and building new financial investment possibilities for individuals who could normally be bitcoin market and analysis excluded from regular marketplaces.

In addition, tokenization improves liquidity, as property that were the moment illiquid or difficult to trade can now be effortlessly transferred or sold on blockchain-dependent platforms. This revolutionizes just how investments are purchased, offered, and managed, driving the growth of world marketplaces.

Cross-Border Payments and Economical Inclusion

Blockchain know-how is also revolutionizing cross-border payments by supplying a a lot quicker, more affordable, plus much more successful choice to classic cash transfer strategies. Previously, sending funds throughout borders generally involved substantial fees, extensive wait periods, and the necessity to rely on third-bash intermediaries. Blockchain-primarily based techniques empower peer-to-peer transfers straight among men and women, eliminating the necessity for banks or other monetary establishments as intermediaries.

This innovation is particularly worthwhile for individuals in building countries or those Operating abroad who have to send out remittances to relatives. Blockchain permits just about instantaneous transfers with considerably decreased charges than regular cash transfer products and services. Additionally, it cuts down the dependency on centralized banks and opens up access to economic products and services for people who may not have access to a banking account.

The Future of Digital Finance

As we look to the longer term, the function of dispersed ledger technologies in reshaping electronic finance is just anticipated to develop. With ongoing developments in scalability, interoperability, and person experience, the adoption of blockchain technology from the fiscal sector will carry on to extend, supplying more complex options into a wider choice of users.

Governments and regulatory bodies will also be starting to recognize the probable of blockchain improvements. Though there remain regulatory worries to handle, many are Functioning to establish frameworks that can stimulate innovation even though making certain the security and protection of consumers. In time, this could lead on to larger mainstream acceptance and even further integration of blockchain-based mostly systems into the global financial ecosystem.

In the long run, the improvements getting driven by blockchain are making a much more inclusive, transparent, and productive financial program. From decentralized finance to Improved safety and tokenized assets, the future of electronic finance is becoming shaped with the transformative power of dispersed ledger technological innovation, and the chances are limitless. As we continue to explore and put into action these improvements, the digital finance landscape will evolve, bringing a few new era of financial flexibility, accessibility, and protection for individuals and enterprises globally.

Danica McKellar Then & Now!

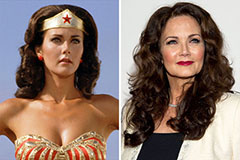

Danica McKellar Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Daryl Hannah Then & Now!

Daryl Hannah Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!